開催日

20220207(月)What you need to know when starting a business in Japan! ~Key Points in Tax and HR~

▼DATE&TIME

February 7th, 2022 Monday 1:00 p.m. to 3:00 p.m. JST

Part①Knowledge of taxes required to establish a company

This seminar allows audiences to learn about basic taxes and procedures. In addition to an overview of the taxes and necessary procedures you need to know before starting a business, we also introduce effective techniques of tax-saving, points to keep in mind, and criteria for deciding whether or not to start a business.

▼Recommended for

・Individuals and international companies, entrepreneurs;

-considering starting up a business in Japan.

-wishing to save tax wisely.

-wishing to learn general knowledge of taxes.

▼Contents

・The general process of establishing a company.

・Main points to be considered when establishing a company.

▼SPEAKER

Tax accountantMr.Mitsuhiro Kashimura.

He has experience working in a leading Tax Accountant Corporation, large mercantile company, bank, overseas consulting firm.

After that, he founded Leads & Company, Inc.and the L&C Certified Public Tax Accountant’s Office in order to establish a comprehensive consultancy group.

He also had worked as a tax advisor, a financial advisor, a supporter, etc. forawide range of industries.

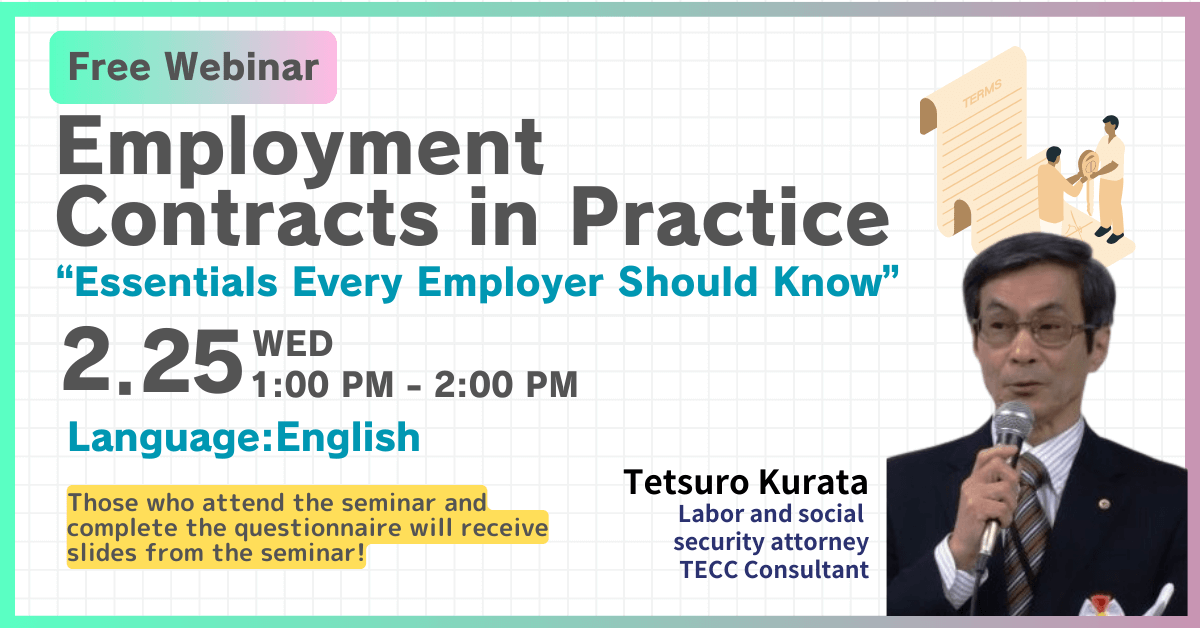

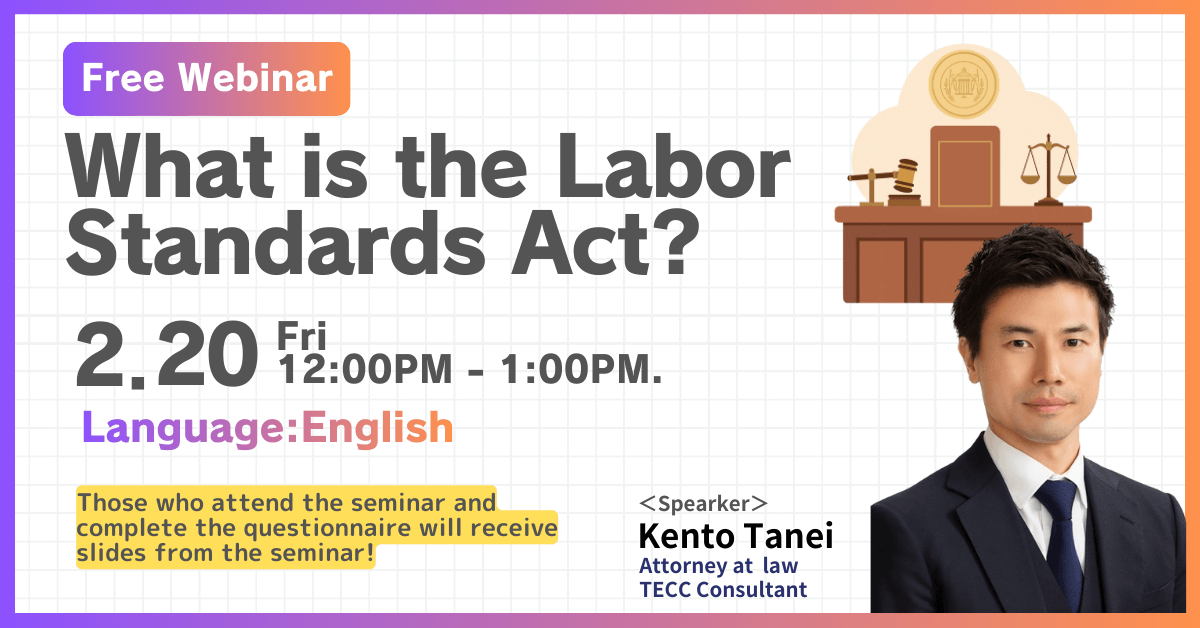

Part②「Need-to-know information about HR in Japan」

In this seminar, you will be able to learn about basic information such as required procedures (social insurance etc.) and a confirmation of employment status (contract of employment) for the representatives who works in Japanese branch of the foreign enterprise. It also includes how to conduct the proper personnel labor management for those representatives.

▼Recommended for

CEO and the person responsible for HR of the foreign enterprise (including the head office and the local subsidiary)

▼Contents

the legal points about HR in Japan

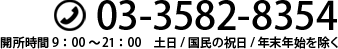

▼SPEAKER

TECC Consultant, Labor and social security attorney Mr. Satoshi Nagaura

He has extensive experience in counseling domestic companies, foreign corporations and foreign-affiliated companies in Japan on employment and labor issues, and has been active as a consultant for TECC for many years. He is also a long-time consultant for TECC. He provides bilingual consultation on labor and social insurance issues.

※Number of participants in this seminar is limited to 50.When the application number reaches the limit, we will close the application.

※This seminar will be held using online tools. Details will be sent to your email after receiving your registration form.